Business & Economics

Why are Australian start-ups failing?

Five Star advice to aspiring entrepreneurs about how to validate the market for a business idea, from the experts who’ve studied it

Published 26 April 2017

Everybody has a plan until they get punched in the face, we say; the punch being the unavoidable encounter with marketplace reality. Modern approaches to entrepreneurship all stress the importance of validating ideas.

So best not to plan too elaborately, too expensively or too speculatively. Instead the recommendation is: to experiment early, cost-effectively and work closely with consumers and other stakeholders.

It all sounds right. And indeed, there are inspirational big success stories from players such as Google, Uber and AirBnB who have adopted the philosophy of quick and iterative marketplace experimentation.

For would-be entrepreneurs this abstract idea causes little trouble. Validation has intuitive appeal, factual proof and big name source credibility.

But the real problem is translating it into practical implementation.

And there are a lot of questions. How do I get started if I want to validate my entrepreneurial idea? How do I know I get the right information? What sort of information do I need anyway? Can I be wrong? Can I go astray while doing it? And who’s going to help me with this?

Fortunately, there is help. We worked through hundreds of real life case studies from successful start-ups, pored through academic research, and tested ideas with actual entrepreneurial teams to arrive at five core principles of validation.

We call the core principles that emerged the Five Stars of Validation. We call them Five Stars because they can help entrepreneurs do validation work at the highest quality possible. They should also serve as clear navigation points for a process, which is at best complex and challenging, at worst confusing and frustrating for entrepreneurs.

So how to undertake marketplace validation for a start-up the Five Star way?

1. FIT

Finding product-market fit (and fast) is the holy grail of entrepreneurship – and it is also the first and most important principle of start-up validation. It is counterproductive and wasteful to develop something the market doesn’t need (think Apple Newton) – and equally, it’s useless to spend time and energy on filling a market need that in reality you can’t (think Theranos).

Business & Economics

Why are Australian start-ups failing?

But how do you find this elusive holy grail of fit? The answer is a dual approach: both bottom-up and top-down. You need to be both empathising with the consumer/market (bottom-up validation) and testing whether the market needs or wants what you have to offer (top-down validation).

An important trick is not be too early with top-down validation when you have a reason to believe that consumers may misunderstand what you have in store for them. It’s better to start with bottom-up empathy for the consumer problem and move to top-down next.

A further key feature of either process is finding ‘insights’ as opposed to just facts. Insights are compelling pieces of evidence that you are engaging with the marketplace in meaningful ways. Insights are novel, striking and never obvious. Ideally, they are things you would not have found, had you been staying ‘inside the building’, that is: merely speculating about your entrepreneurial idea rather than testing it in real life.

2. TIME

A common mistake that entrepreneurs make when validating ideas is thinking that product-market fit is a point-in-time measure. It isn’t: it is a dynamic, over-time measure.

To cope with the dynamic nature of validation you will have to engage in some strategic time-travel. You need to collect evidence that you will be able to compete in the future, rather than just in the present or the past.

It’s understandable that many models of validation (such as classic new product concept tests in market research) have been stuck in a static, time-free and past-facing way of thinking. After all, many experiments suggest they discover timeless truths and the results should endure. Entrepreneurship is much more dynamic than that.

Many start-ups and innovations fail not because their value propositions are wrong but because they don’t get the timing right: they are either too early (Microsoft’s early notepads), or too late to market (their Zune mp3 player).

So how do you know if you have the timing right? The answer is you need to design validation that directly tests the time aspect of your value proposition. Working with consumers, for instance, you need to collect evidence that the value proposition is offered at the right time and will really work for them in the future.

3. DE-BIAS

The fundamental role of validation is to provide evidence for product-market fit for the start-up and its investors. Validation also serves another purpose: to boost the confidence of the founder facing many uncertainties throughout the entrepreneurial journey.

Business & Economics

The next big things in on-demand

Inadvertently, however, many cognitive biases enter the life of entrepreneurs and validation work is no exception. Despite knowing that biases are deadly because they undermine the market-based pillars of venture success, we all have them.

What to do? Five Star validation work has to face inward as well outward: and actively fight cognitive biases that may enter your fact-finding. Research has shown that simply knowing about biases can bust some of them.

A starting point is ruthless honesty: are you biased in how you plan, collect and interpret validation information? Are you reading into the data what you want to hear and see? Almost always, there should be a gulf between initial hypotheses and what market experimentation data brings back. If there is no tension between facts and what you imagined, chances are: you shaped reality to match your dreams.

It is also critical to talk to the right segments of the market. While there are sophisticated segmentation methods in market research and consulting, they are prohibitively expensive for a typical start-up. But this fact should not prevent you from finding ‘consumer archetypes; and should not commit you to get irrelevant data from the wrong segments. Crucially, you want to avoid data collection targeting FFFs -Friends, Fools and Family: they are biased in many ways and overeager to try to ‘help’ you to hear what you want to hear.

Further, do your validation in a ‘constant comparison’ mode with competition. Are you collecting data about your distinct edge or just the industry average? You know deep in your heart that the average will not cut it – so do not inadvertently amass fake evidence that the market will take such an average from you either.

4. ACT

Successful entrepreneurs are biased in one good way: they are biased for action. Vision is great to have but it is never enough. Action-orientation from day one is an absolute must.

The same principle applies to validation. What are you going to do with the data you collect? Is it going to end up in an unstructured mess, sitting as a pile of paper on your desk or in digital form in the cloud somewhere? Or are you ready to jump on this data to structure it, interpret it and derive actions from it the moment you receive it – knowing that any hour wasted is playing into the hands of competition? The answer is obvious, but the methods to achieve it are less so.

The key is to act before you act. In other words, plan for action even before you start any preparations for the validation process narrowly defined. What are you going to do with the data? What are the specific decisions that you will make once you have this data?

Suppose the market says your value proposition is dead wrong, are you ready to take a complete 180-degree turn? If it suggests a smaller but inconvenient tweak are you willing to do it? And how many pivots can you take before you run out of runway?

Business & Economics

Equity crowdfunding: Seeing through the hard sell

A critical feature of action-oriented validation is to have a measurement and learning plan in place: what will you find out, through what metrics, what methodological approach, provided by whom, by when and what is at stake?

Data is dangerous and the only way to contain it is to have a systematic plan in place for what to do with it. Having done action-based validation right, you can avoid both inaction – a common outcome of half-baked validation attempts – and taking the wrong set of actions – a common outcome of not validating at all.

5. GROW

We have already mentioned that timing the market as a critical validation tool. But there is another sense in which time can be a proverbial ‘punch in the face’ for entrepreneurs.

Even if initial product-market validation is positive, and the value proposition is well-timed for the market, there is no guarantee that it will stay that way medium-term. Concentrating on initial value proposition validation, entrepreneurs often miss growth proposition validation: testing ideas with the marketplace about where future growth will come from.

“Isn’t this too much to ask for?,” you may object, “I’m just starting out. I don’t even know if it will work. Validation is messy anyway. Are you seriously telling me that I need to test another set of hypotheses for future growth not just my value proposition?”

In a nutshell, yes. Many startups fail not on initial take-up but in the medium term when they fail to grow. This has been called a Valley of Death. It’s quite an uncanny valley. Early adopters disappear, evangelists start to evangelise for others, and the runaway scale-up for which VCs took most of your equity is just not materialising. Granted, Valleys of Death can have many causes, often being both unforeseeable and uncontrollable.

Business & Economics

Why innovation requires a mix of skillsets

But this is not an excuse to avoid thinking about growth on day one and test hypotheses for it specifically – on day one. You want to ask yourself: Have you formulated and validated ideas for repurchase, viral spread and network effects? Can you test ideas for cross-sell, up-sell and concept iterations for different segments?

Ideally, formal growth forecasting is part of your validation process (typically, later than day one). Doing so is important not to produce the oft-seen fantasy hockey-stick growth curve, a staple of VC pitch decks. Certainly, we are not advocating the generation of this type of fictional growth ‘validation’. Real growth comes from reliable data testing growth hypotheses, not from speculation and wishful thinking.

Finally, you want to turn your testing arsenal again inwards: do you have the resources to outlive the Valley of Death? Do you have the financial means and organisational capabilities to persist and live for a better day, if you anticipate growth to pick up only medium term?

The Five Stars demonstrate that marketplace validation is not a simple matter. In fact, validation is part of the entrepreneurial core, which needs as much attention and resources as technical development or the pursuit of financing.

Fortunately, following the above five principles, coupled with expert advice and professional execution, can set you on the right path for venture success, the most gratifying form of validation of all.

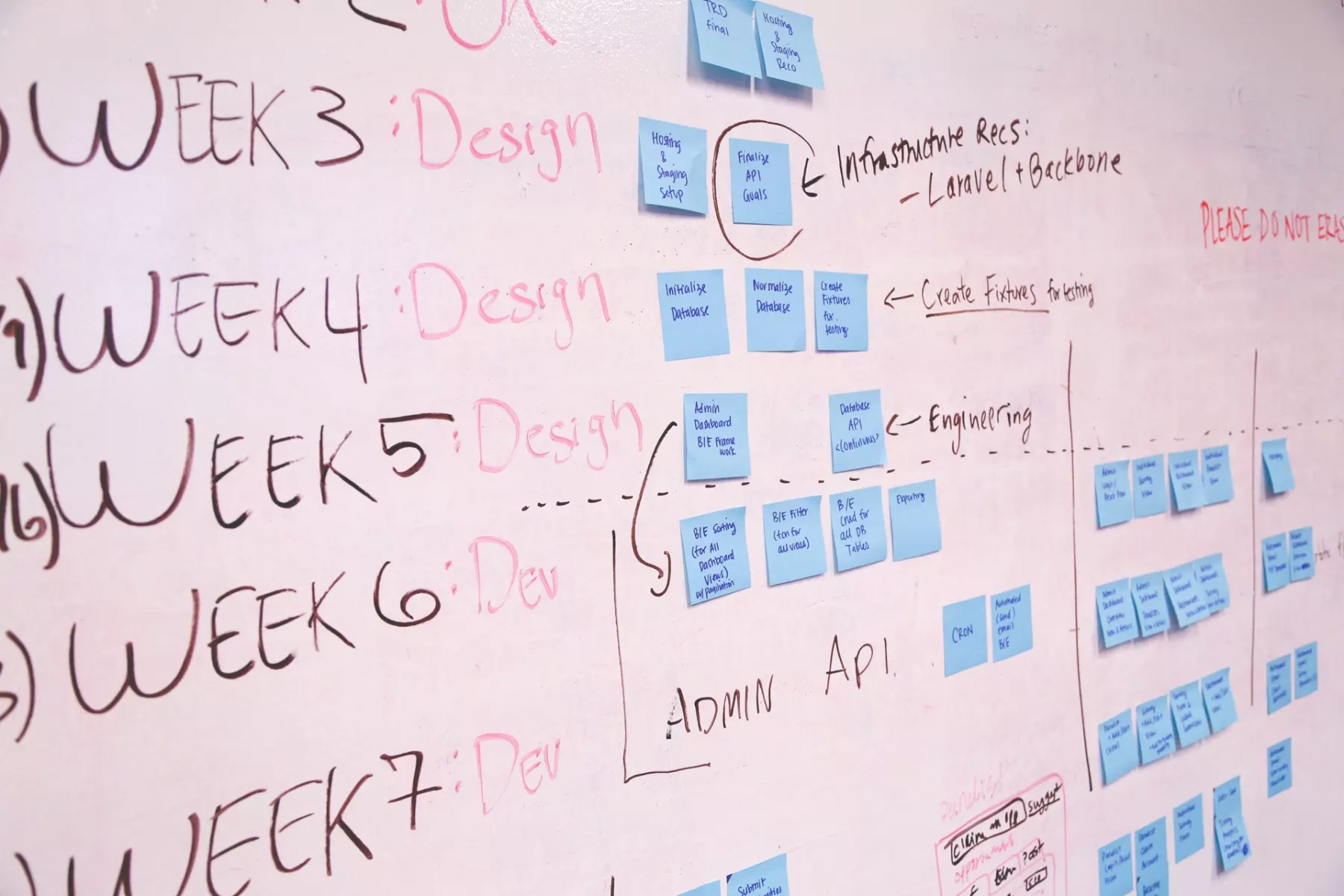

Banner image: Pexels